13 dollars an hour 40 hours a week after taxes

If they are paid 12 an hour that comes to 288 per. 13 per hour is 27040 a year.

Federal Tax 15k Salary Example Us Tax Calculator 2022

Put simply if you work full-time 40 hours a week your income after taxes net income will be 49920.

. Since there are 52 weeks in the year you can multiply 10 dollars by 52 weeks and 40 hours to calculate your approximate annual salary. For example if you did 10 extra hours each month at time-and-a-half. Take 40 hours times 50 weeks and that equals 2000 working hours.

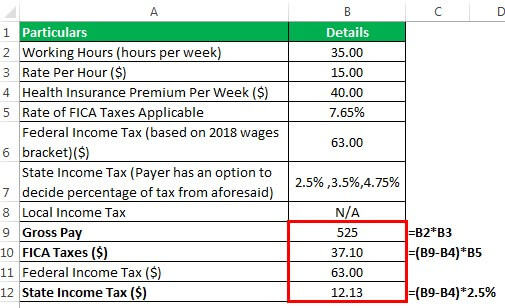

To calculate how much you make biweekly before taxes you would multiply 65 by 40 hours and 2 weeks. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. Things change when you add taxes to the mix and you have to do it to know the amount of money you can.

A typical full-time work week consists of 40 hours. You earn 27040 a year after working 40 hours a week for 13hour before taxes. Denzil only fools and horses quotes.

Assuming 40 hours a week that equals 2080 hours in a year. 4013 Work hours per. Keeping this in view what is 13 an hour after taxes.

Hourly wage 2500 Daily wage 20000 Scenario 1. If you make 13 an hour you will get paid 520 a. This number is based on 40 hours of work per week and assuming its a full-time job 8 hours per day with vacation time.

40 hours x 50. 13 an Hour is How Much a Week. A project manager is getting an hourly rate of 25 while working 8 hours per day and 5 days a week.

A worker who works the 8-hour graveyard shift 3 nights a week at the gas station is working a total of 24 hours. His income will be. If you work part-time 25 hours a week your take-home pay will be.

Answer 1 of 6. Do the math yourself and then deduct a gross amount of about 28 for the different taxes that are deducted from your gross earnings to learn what is your take home pay. 13 an hour is how much annually.

Then multiple the hourly salary of 13 times 2000 working hours and the result is 26000. Our calculations are based on the following information but you can change the numbers further down on this page to make it better reflect your situation. Your hourly wage of 13 dollars would end up being about 27040 per.

To calculate how much you make biweekly before taxes you would multiply 13 by 40 hours and 2 weeks. See where that hard-earned money goes - Federal Income Tax Social Security and.

Take Home Paycheck Calculator Hourly Salary After Taxes

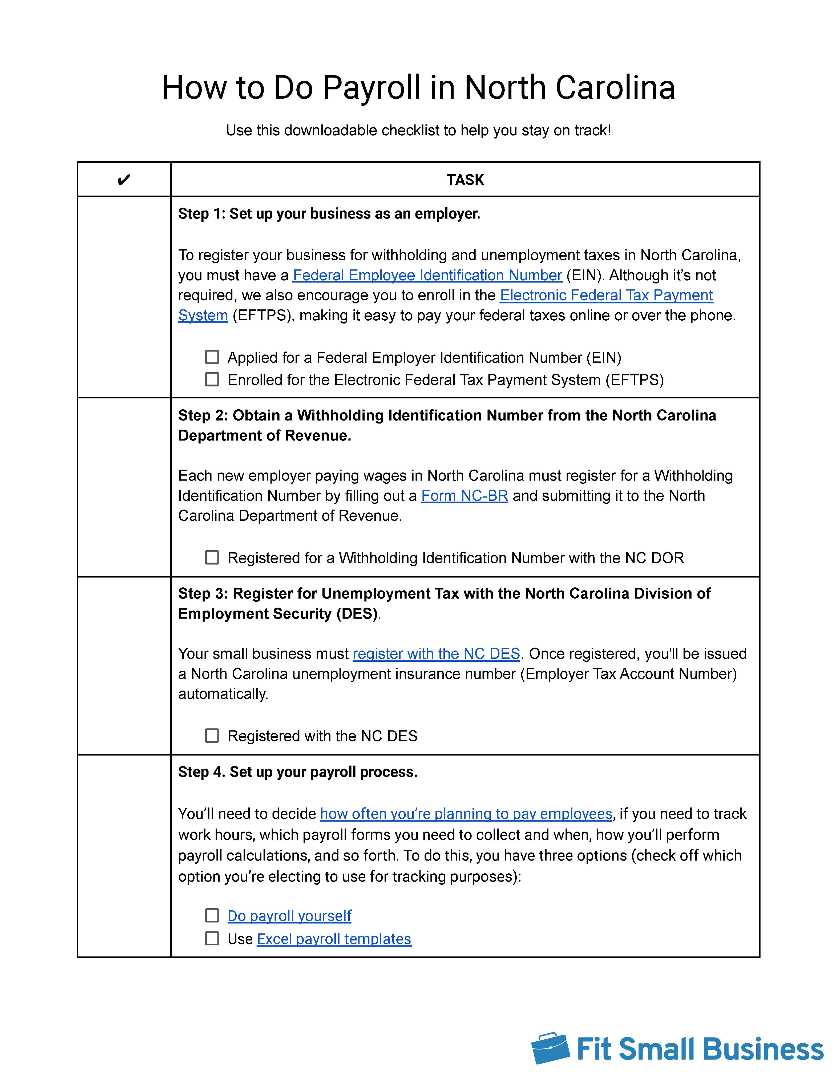

How To Do Payroll In North Carolina Detailed Guide For Employers

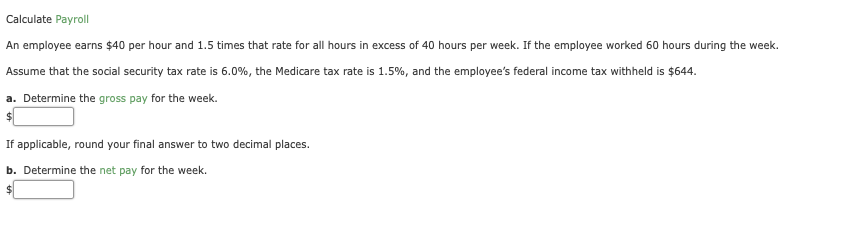

Solved Calculate Payroll An Employee Earns 40 Per Hour And Chegg Com

Many Lower And Middle Income Households Could Pay Zero In Taxes

![]()

Income Tax Calculator 2022 Usa Salary After Tax

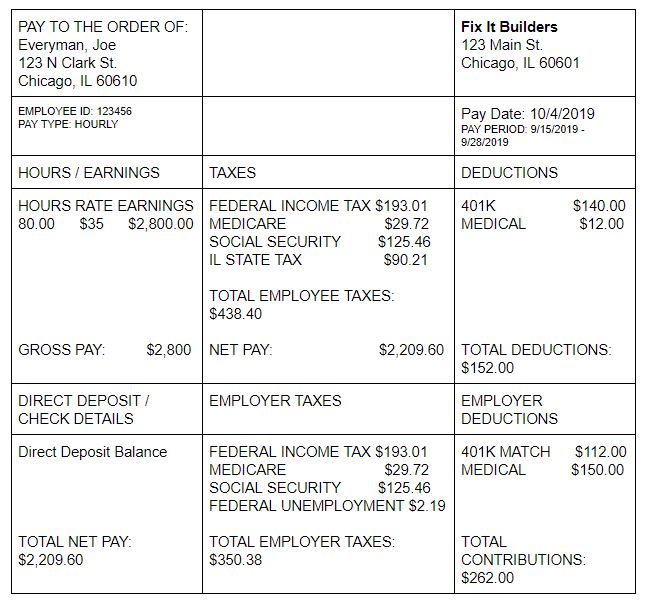

How To Read A Pay Stub Understanding Your Pay Stub Oppu

19 Dollars An Hour Is How Much A Year Example Budget Included

Hourly Income To Annual Salary Conversion Calculator

Payroll Tax Calculator For Employers Gusto

Biden S Minimum Wage Exaggeration Factcheck Org

Take Home Pay Definition Example How To Calculate

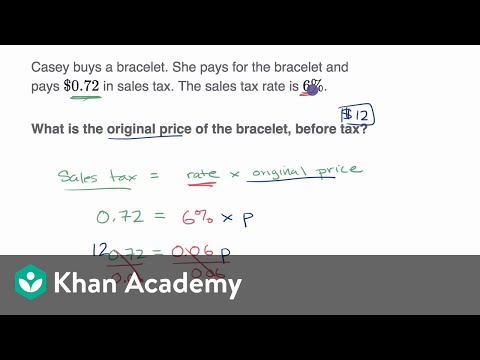

Percent Word Problems Tax And Discount Video Khan Academy

Here S How Much Money You Take Home From A 75 000 Salary

Office Of The State Tax Sale Ombudsman

85 000 A Year Is How Much An Hour Zippia

15 An Hour Is How Much A Year Stack Your Dollars

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

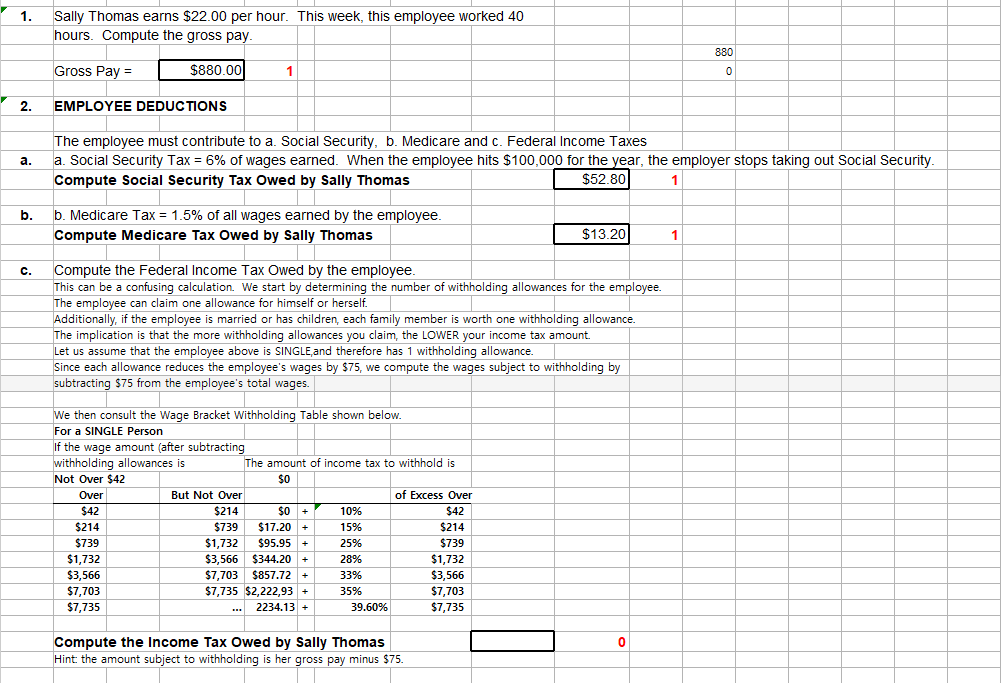

Solved 1 Sally Thomas Earns 22 00 Per Hour This Week Chegg Com