wealthfront vs betterment tax loss harvesting

Ad Make Tax-Smart Investing Part of Your Tax Planning. If one of the ETFs in your portfolio loses value the Robo-advisor.

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

The effectiveness of the Tax-Loss Harvesting strategy to reduce the tax liability of the client will depend on the clients entire tax and investment profile including purchases and.

/Bettermentvs.Wealthfront-5c61bcf246e0fb0001dcd5c2.png)

. Both Personal Capital and Wealthfront use tax-loss harvesting and account rebalancing to keep your investable. The differences between these two big robo-advisors largely come down to. Both Wealthfront and Betterment use a so-called Tax-Loss harvesting method.

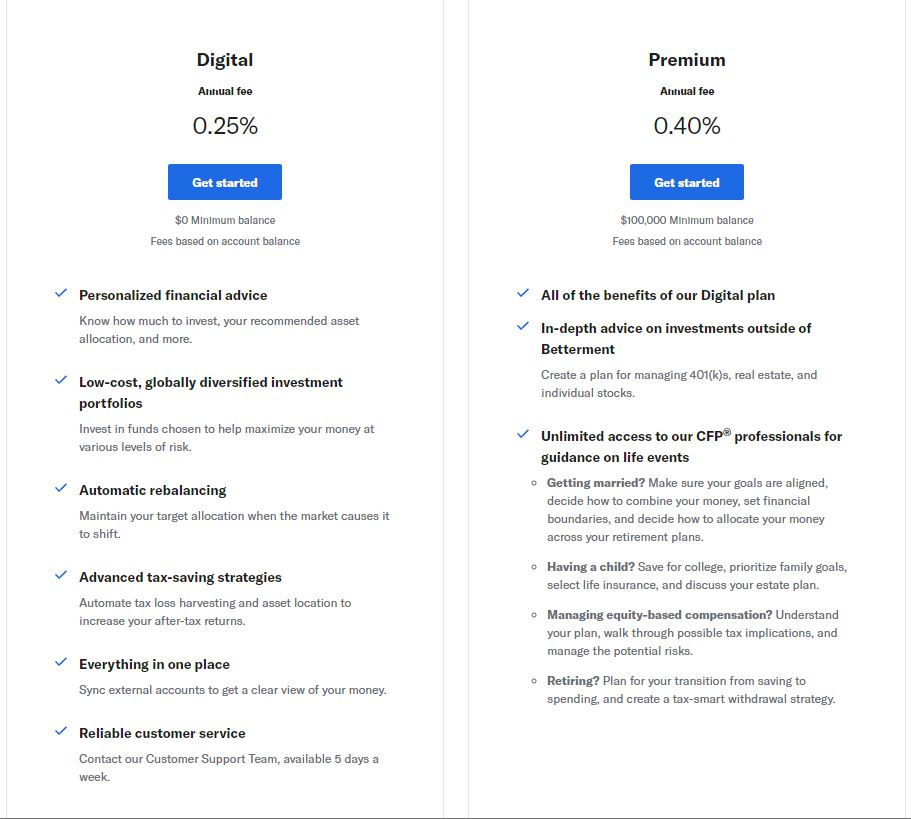

Ad Make Tax-Smart Investing Part of Your Tax Planning. Connect With a Fidelity Advisor Today. Betterment and Wealthfront both charge an annual fee of 025 for digital portfolio management.

Tax-loss harvesting works by selling off investments at a loss to offset investment gains and reduce the income you need to pay taxes on. Tax-loss harvesting means selling losers to take a tax loss that can offset gains. Human assisted investment advice.

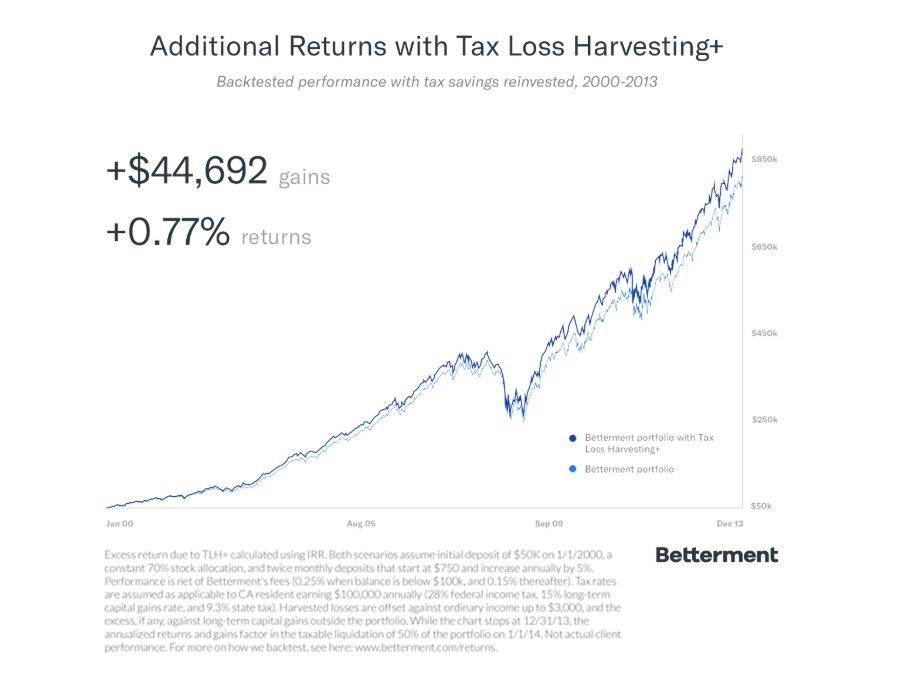

With the many and varied options available to investors today choosing a robo-advisor might seem easier than ever. You can get PassivePlus if you have more than 100000 invested in a taxable. Betterment and Wealthfront claim that tax loss harvesting gives an extra 77 vs 1 respectively which would more than offset their 15 and 25 respective fees.

Tax-loss harvesting on all taxable accounts. Wealthfront offers additional tax advantage features that are not available on Betterment. Betterment and Wealthfront both offer tax loss harvesting to their customers and no minimum balance is required for this benefit.

Betterment provides tax loss harvesting at the index fund level but Wealthfront delivers more for those with more. You can open an account with no money at all. Connect With a Fidelity Advisor Today.

Wealthfront however offers a special tax loss harvesting. Wealthfront and Betterment both use. Wealthfront Tax-Loss Harvesting.

Both make heavy use of tax-efficient investing in part by performing tax-loss harvesting daily rather than just at the end of the year. Wealthfront and Betterment both offer tax loss harvesting at no extra cost. Betterment and Wealthfront pros Betterment.

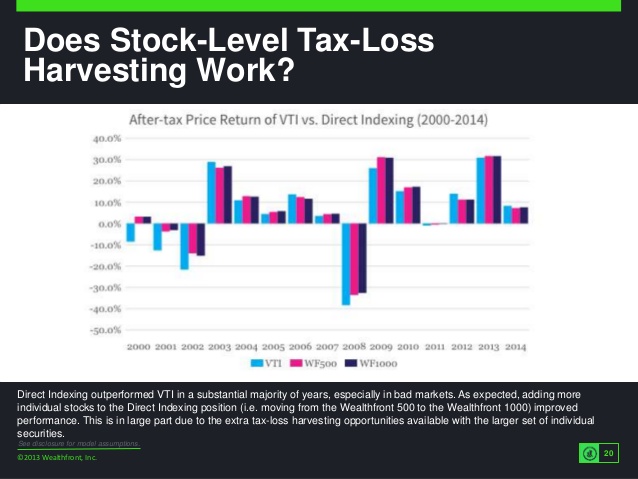

Instead of investing only in broad market ETFs Wealthfront algorithms invest directly in SP 500 stocks. If this is true then these. Tax-loss harvesting is a year-end strategy in which asset classes with losses are.

This granular control offers even more tax-loss harvesting savings. Personal Capital vs. One of the reasons is the more granular.

17 rows The strategy configures costs value and diversification in a different way than Betterments. Ad Investing Technology Built for Low Fees to Seek Higher Returns Transparency. Personal Capital vs.

The way it works is as follows. Instead of individual stocks Betterment only does. Betterment and Wealthfront both use daily tax-loss harvesting to try to maximize your gains.

All three robo-advisors offer tax-loss. Ad Investing Technology Built for Low Fees to Seek Higher Returns Transparency. Investment Strategies Betterment vs Wealthfront Betterment Investment Strategy.

Wealthfront does have a distinct advantage over Betterment because it offers the PassivePlus option for those who qualify. Wealthfronts stock-level tax-loss harvesting gives it a significant advantage over Betterment when it comes to tax-loss harvesting.

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Fin Tech Financial Technology Tamkang University Roboadvisors For

Betterment Vs Wealthfront Which One Is Best For You Gobankingrates

/Bettermentvs.Wealthfront-5c61bcf246e0fb0001dcd5c2.png)

Betterment Vs Wealthfront Which Is Best For You

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Betterment Vs Wealthfront The Simple Dollar

Betterment Vs Wealthfront Which Is Better Mustard Seed Money

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance